86-115EH hashrate drop is expected upon Apr halving. Next-gen mining rigs entering into under 20J/TH world

HASH WAR INTENSIFYING

As next Halving is coming around 20th April, mining industry is entering into a crazy unforeseeable storm.

As at this post, Bitcoin’s network hashrate is c.600EH, which is almost doubled for the past 1 year.

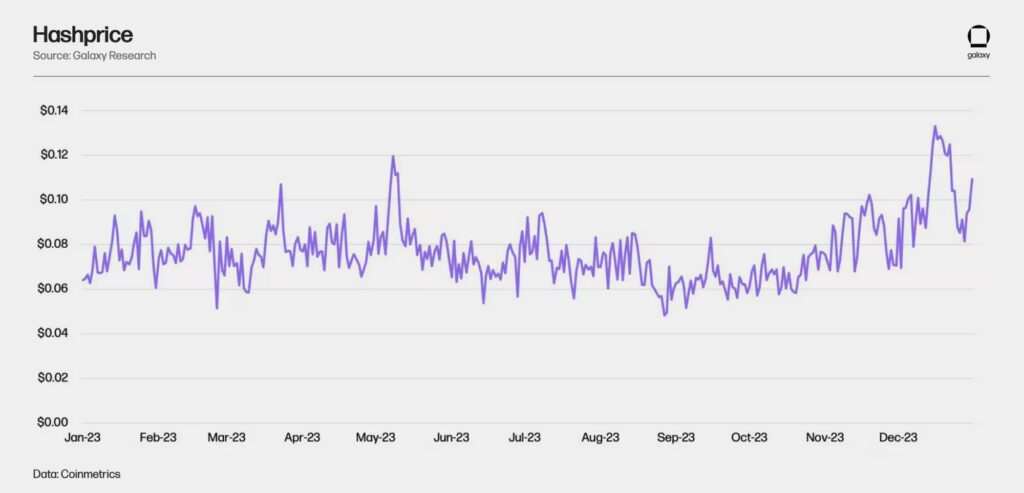

Despite recent rally especially after spot ETF approval, hash price basically moves within “range”, due to the intensive hashrate build-up.

As block reward will halved from current 6.25 BTC to 3.125 BTC upon coming April halving, Galaxy predicts 15-20% / 86-115EH of network hashrate becomes offline.

As miners aggressively installing new generation rigs, Galaxy predicts 2024 year-end network hashrate will reach 675-725EH. Of course, all subject to price action!

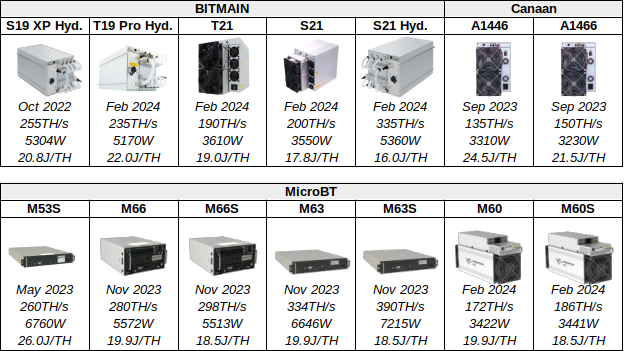

NEXT-GEN RIGS

From late 2023, new generation SHA-256 rigs were gradually released and Efficiencies is entering into under 20J/TH level.

In February, long-awaited Bitmain’s 21 series were finally shipped.

S21

With 17.8J/TH efficiency, S21 is one of the most competitive model in the market.

Let’s say, if you bought S21 by $3,500/unit and your datacenter has 7cents/kWh tariff, on 3.125 block reward after halving, your S21 generates $12.9 revenue & $6.9 profit per day if BTC price reaches $100k & network has 700EH. ROI will be 508 days in that case… (* Transaction fee impact isn’t considered in this sensitivity analysis)

Based on various web sources, One thing I want to note on S21 is overheating issue.

So far, our S21 operates without any problem, but careful heat monitoring is recommended.

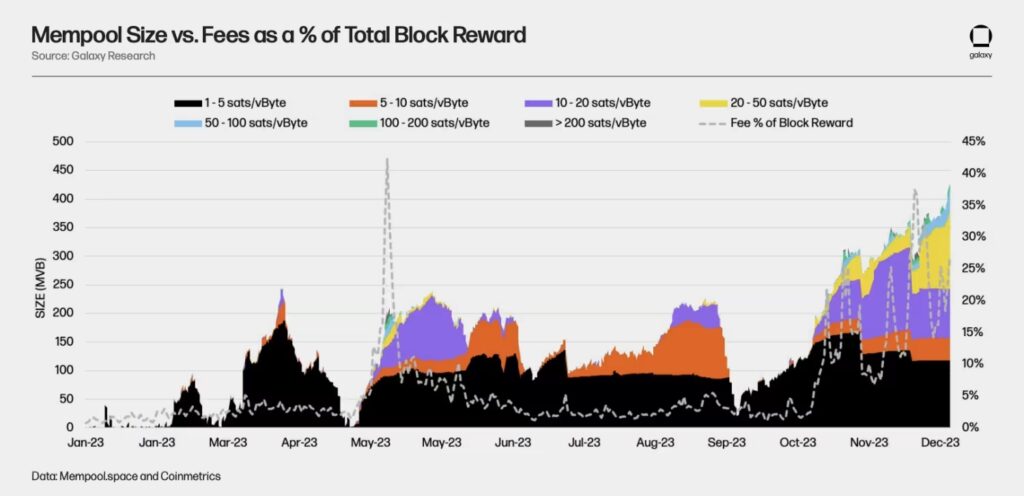

WILD CARD – TRANSACTION FEE

A positive but unpredictable wild card for miner is a transaction fee.

Ordinals and other emerging new token standards are bringing new use-case to Bitcoin blockspace and the transaction fee generated from their NFT etc activities is no longer negligible.

In late 2023, transaction fee reached c.25% of total block reward, this is equivalent to c.50% of block reward post halving.

If this trend continues, it will largely mitigates halving impact to miners. And note that we are just in “Genesis” phase of emerging blockspace dynamics, i.e. further upside may be coming.

Of course this may be “exploitation” of Bitcoin blockspace, thus a potential ban of Ordinals can happen. So, it’s highly unpredictable wild card, but at the same time transaction fee is becoming crucial factor for building a sustainable ecosystem of Bitcoin network.

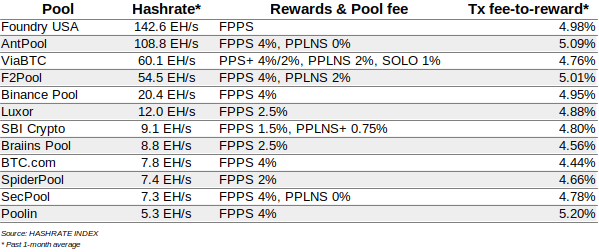

Note that your mining pool may steal a part of the transaction fee. Checking a proper distribution of transaction fee is becoming crucial factor to choose the pool.

You can check fee-to-reward ratio on HASHRATE INDEX.