Ambitious Kadena project and its first ASIC miner BM-K1 introduction, while extreme mining dilution is a concern

KADENA PROJECT

Polkadot, Cardano, Nervos Network, Avalanche, etc… There are so many “Ethereum Killers” in market. Today, let me introduce an another potential Ethereum Killer project, Kadena.

Founded by ex-JP Morgan engineers in 2016, Kadena is an ambitious project of building an ecosystem for distributed applications, safely shared business workflows, and flexible governance mechanisms for the modern age.

In business circumstance, practicality and easiness is sometimes more important than technology. Kadena’s answer on this matter is Pact, a human-readable smart contract language. Sample code well proves easy implementation of basic functionality.

Parallel-chain proof-of-work architecture Chainweb provides a speed and scalability. Chainweb has the potential to grow to at least 1,250 chains executing upwards of 10,000 transactions per second, without significantly increasing hash power.

Leveraging above-mentioned strength, Kadena is launching a DEX, Kadenaswap, which can process 480,000 transactions per second sitting atop Kadena’s public blockchain. Awesome!

Community is pretty active. You can confirm frequent update in Github and regular posting in Medium. This is definitely an interesting project to watch.

KDA PRICE

Kadena (KDA) is listed on Hotbit, Hoo.com, Bittrex, CoinEx and Coinmetro. Market cap as of this post is just $10mn!

Following DeFi hype and dump in this summer, KDA price entered into 3-months continuous downward correction and is now under around $0.2 level forming a rounded bottom, i.e. on the verge of trend reversal vs. trend continuation.

Now crypto market is entering into Alto-season, which is of course supportive to KDA. Also, if Kadenaswap testnet is launched within this year as planned on roadmap, trend reversal may be confirmed and KDA may enter into upward trend.

A challenge KDA will face is resistance range in $0.26-0.48 level. Even trend reversal is confirmed, KDA may be stuck in $0.26-0.48 level for a while till next catalyst. Even KDA beats $0.26-0.48 resistance, there are other resistance in $0.5 and $0.75, which is presale price to investors. If KDA beats these resistance and reaches all-time-high $0.9 level, parabolic hype may come.

Downside risk is big. If KDA continues toward downside, next support is around $0.07, which is very weak support. The risk that KDA breaks down the $0.07 support line and enters into all-time-low is not small. Be careful. I personally bought small amount of KDA, but careful trader may be patient a bit more and wait confirmation of trend reversal.

As pointed out in the following KDA MINING section, an extreme dilution of KDA is pretty negative for price development. ZCASH experienced 3-years continuous downside correction due to its dilution and same nightmare can happen for KDA as well.

A good news is iBeLink’s launch of BM-K1 Kadena mining machine. ASIC manufactures are very cautious when they support new algorithm. If there is no enough demand for new machines, manufacturers have to bear unsold inventories, so they basically only support promising algorithms/coins. ASIC adoption is a good credential for new algorithms/coins.

KDA MINING

Kadena’s network hashrate recently moves around 2PH/s level. The biggest pool is F2Pool, one of the largest mining pool. F2Pool’s adoption is an another supporting fact for Kadena project.

Current block height is around 1.128mn, block time is 30 seconds and block reward is 22.32462, i.e. daily supply is around KDA 64,295. Based on reward schedule, the block reward is reduced by around 0.29% every month (every 87,600 block).

One point I want to note here is an extreme dilution of KDA. Current KDA supply is KDA 49.5mn, however new KDA 64k is generated every single day… This dilution will pretty negatively affect KDA’s price development.

OK, let’s have look at iBeLink BM-K1. Hashrate is 5.3TH/s and power consumption is 800W. Note that existing FPGA miners’ hashrate for Kadena is at most 90GH. Upon implementation of hundreds units of BM-K1, network hashrate will skyroket and FPGA/GPU miners will be kicked-out.

whattomine computes daily mining reward of BM-K1 as $41.34 so far, but of course this revenue will rapidly be reduced upon implementation of BM-K1.

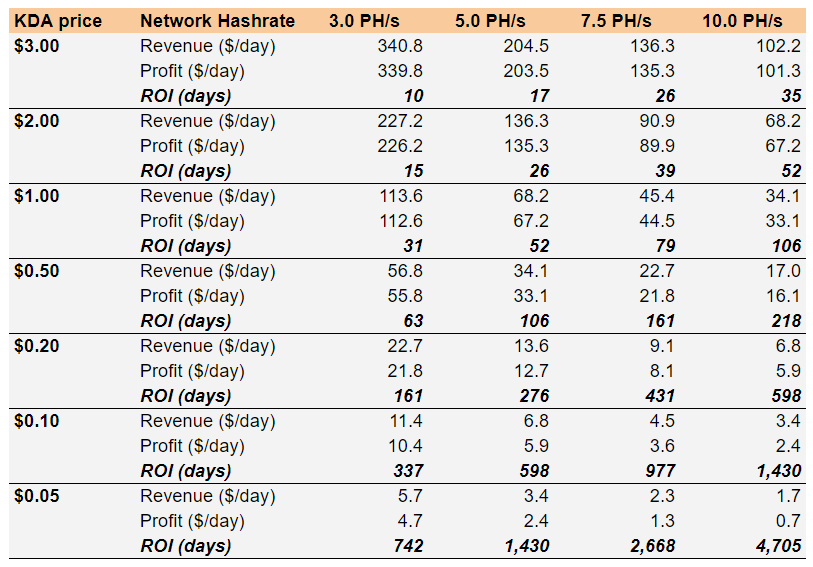

Let’s imagine after 1-year when mining reward will be reduced to 21.56417, i.e. KDA 62,104 is mined daily. How’s mining profitability of BM-K1, if any competitor ASIC model is not released?

I have no idea how many units of BM-K1 will be produced, but let’s say 2,000 units will be produced and network hashrate will reach max 10PH/s level in 1 year. Assume unit price + shipping/installing cost is $3,500/unit and electricity tariff is $0.05/kWh.

BM-K1’s mining profitability and ROI is absolutely subject to KDA price! Given the high-dilution nature, mining coins are enough supplied. The matter is coin price!

If KDA price becomes $0.50, even if network hashrate reaches 7.5PH/s level, ROI is just 161 days. Pretty good investment.

However, if price drops to $0.10 level, even recovering original invested amount ($3,500) should be difficult.

My recommendation is to carefully watch KDA’s price direction, before making machine purchase decision.

An another risk is another ASIC maker may release better machines with much higher hashrate. It often happens in new algorithm. If it is the case, BM-K1 might have the risk to be kicked-out from KDA mining scene. The higher KDA price is, the higher competitor risk is.

[crypto-donation-box]