Parabolic price hike & legacy miners’ capitulation expected

Count down to ZCASH Halving on 18-Nov! What will happen to ZEC price and mining?

PRICE

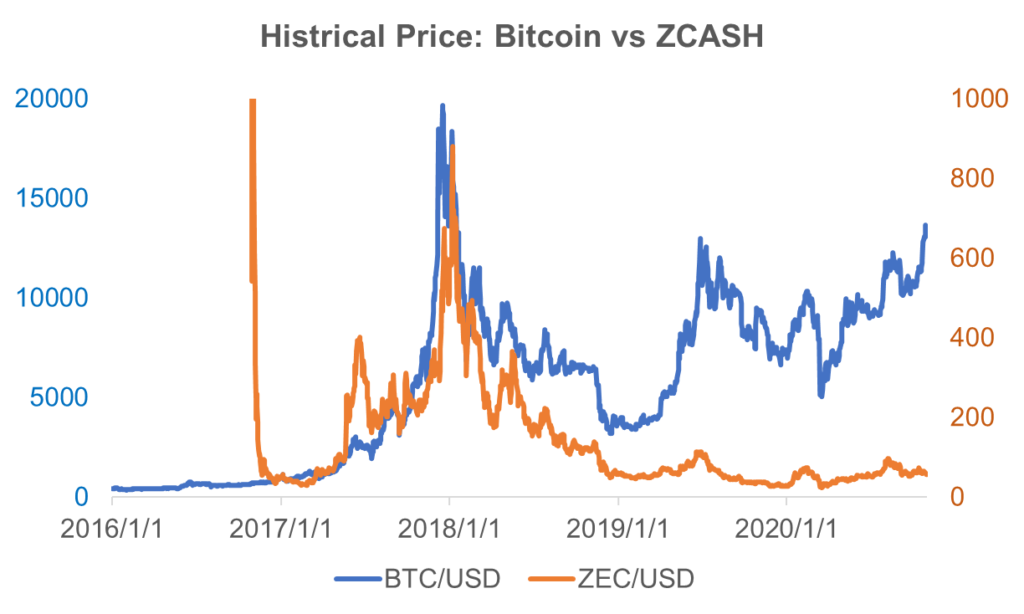

Following 3-years bear trend, analysts expect first ever bull run is coming for ZCASH.

The biggest problem of ZCASH is extreme inflation (dilution by new coin generation) of 25% per year (v.s. 1.7% of BTC / 5.9% of DASH / 2.0% of XMR), which has caused continuous bear trend.

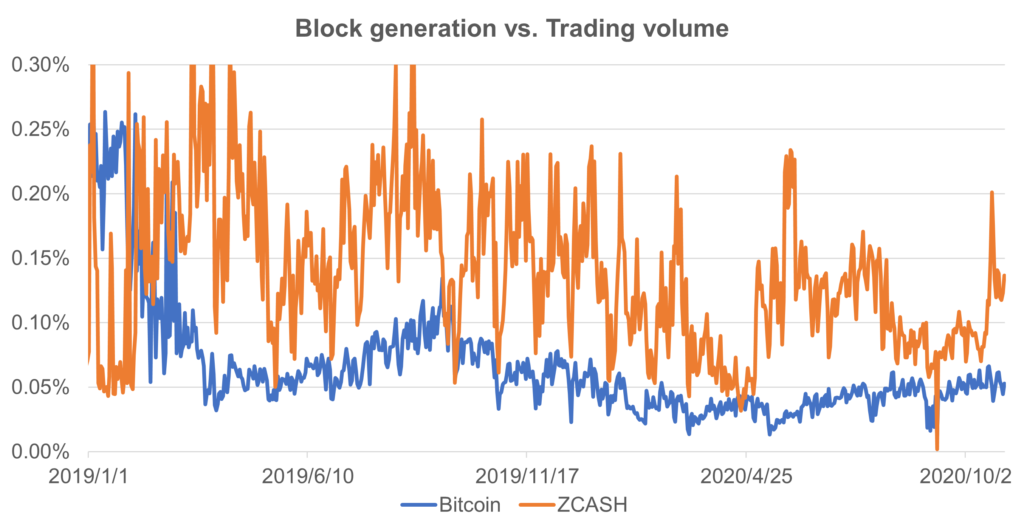

Below chart shows historical data of daily new block generation vs. daily trading volume of Bitcoin and ZCASH.

After 2020 May halving, 900 new Bitcoin is generated per day, while daily trading volume was around 1-7mn Bitcoin. The ratio of new block generation vs trading volume was around 0.04-0.07%.

In ZCASH, this new generation vs. trading volume ratio in the same period was around 0.1-0.23%, i.e. 2-4 times larger mining dilution was held vs. Bitcoin. Upon halving on 18-Nov, ZCASH mining reward becomes half, thus daily mining dilution will expected to be similar level with Bitcoin. That is supportive for positive price development.

However, one point I want to note as miner is that mining nature of Bitcoin and ZCASH is different. In Bitcoin, miners keep mined BTC and use them for purchasing new mining machines. Of course, mined BTC are converted to fiat to pay operating cost or secure profit, however miners’ selling pressure in BTC is relatively modest vs Altcoins. In ZCASH, mining pools provide automatic conversion of mined ZEC to BTC and many miners use this feature. So mined ZEC is immediately sold and converted into BTC. Even ZCASH’s daily mining dilution drops to BTC level, still miners’ selling pressure in ZEC is still immediate and much stronger than BTC.

From technical analysis perspective, ZCASH has historical volume trade zone in $47-$67, where ZCASH is captured currently. A bad news is Altseason is ending right now, so if ZCASH dips below $47 shortly, this $47-$67 volume zone becomes huge resistance, which will delay post-halving bull-run.

Once ZCASH enters into $70 zone, there is no big resistance, thus post-halving parabolic bull-run becomes realistic. An Analyst targets $90 as short-term and $180 as mid-term reasonable price expectation, while target price range widely varies by analysts.

Recent introduction of “Wrapped” ZCASH on Ethereum chain is an another supporting news to develop ZCASH ecosystem.

MINING

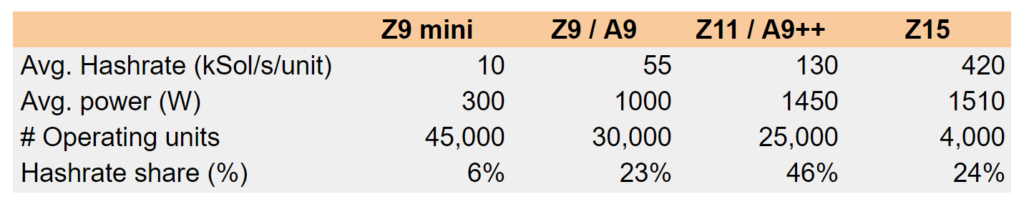

Luxor published an interesting report, on which Luxor pool’s ZCASH hashrate contribution by models is disclosed (skewed to new models in Luxor pool).

Based on this report and recent hashrate evolution (around 6.0-7.0 Gsol/s) after release of new Z15 model, I estimated following operating machines distribution by models as at October 2020 (GPU miner is ignored). Despite the marketing push by Bitmain, I guess just around 4,000 units of Z15 are under operation, since (i) recent ZCASH price recovery makes older models enough profitable to keep operating, and (ii) miners are waiting for Z15 discount post halving.

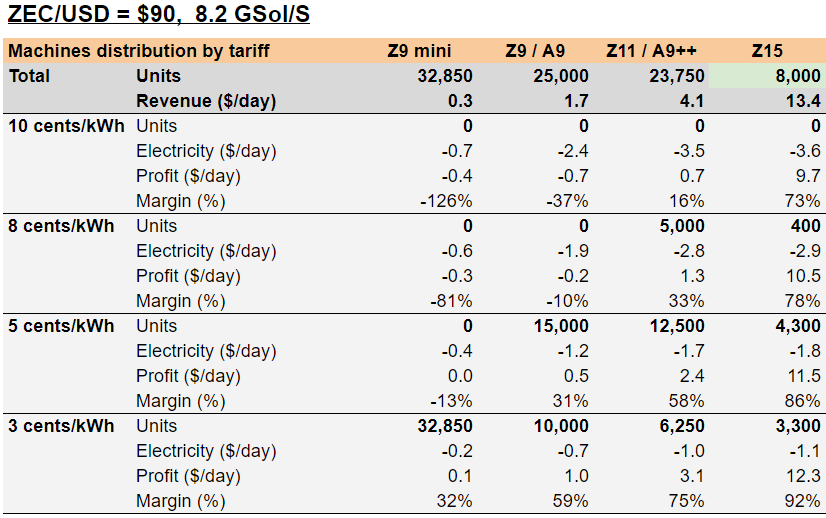

Below is absolute my guess based on communication with miners in Central Asia, China and Europe. I allocated each model’s distribution by miners’ electricity tariff. Again this is just my GUESS.

Based on some sources, I guess average tariff in mining industry is somewhere 4-5 cents/kWh, and now battle field is moving toward 3 cents/kWh level mainly in Kazakhstan, Russia, Iran, USA or by energy industry players.

I guess volume zone of ZCASH mining is average miners, i.e. 5 cents/kWh. On the other hand, legacy small miners with 8-10 cents/kWh mainly in Europe etc. manages to survive, however I suspect they will not make much additional investment for Z15.

So what will happen to miners upon halving?

Imagine the case that additional 2,000 units of Z15 (total 0.8 GSol/s) to be shipped upon halving and ZCASH price is still stuck around $57 level, while mining reward becomes half. In this case, large amount of Z9 mini, Z9 / A9 and even part of Z11 / A9++ generation models enter into red zone, thus they will be stopped. Because of old models’ capitulation, total hashrate will remains stable around 7.0GSol/s level. I guess this will be the new mining landscape just after 18-Nov halving.

Following above halving event, imagine another 2,000 units of Z15 is shipped in months and ZEC/USD reaches $90 psychological resistance level, ZCASH becomes mining paradise. Z15 miners enjoy 70%+ margin and Z11 / A9++ miners can survive even in legacy 8 cents/kWh data center. Assume part of Z9 mini / Z9 / Z9 / Z11 miners capitulated upon halving will be transferred to 3 cents/kWh miners. Total hashrate will reach 8.2 GSol/s level.

Of course, we have to prepare worst case scenario. Imagine ZEC/USD is trapped under volume resistance level and dumped to $35 level. In this scenario, Z9 mini will be wiped out from market and Z9 / A9 can’t survive even in 5 cents/kWh. Network hashrate will drop to 6.3 GSol/s level. Such story could happen and once ZEC/USD enters into below $47 support level, downside correction may take long period.

Hope this analysis helps ZCASH miners. Should anyone shares additional information especially model and tariff distribution, I can update my analysis.

[crypto-donation-box]